pinellas county sales tax calculator

The Pinellas Park sales tax rate is. 8AM TO 5PM MON - FRI.

Business Tax Summary Pinellas County Economic Development Pced

Ad Find Out Sales Tax Rates For Free.

. All applications for title must be signed with the applicants full name. Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Actual property tax assessments depend on a number of variables.

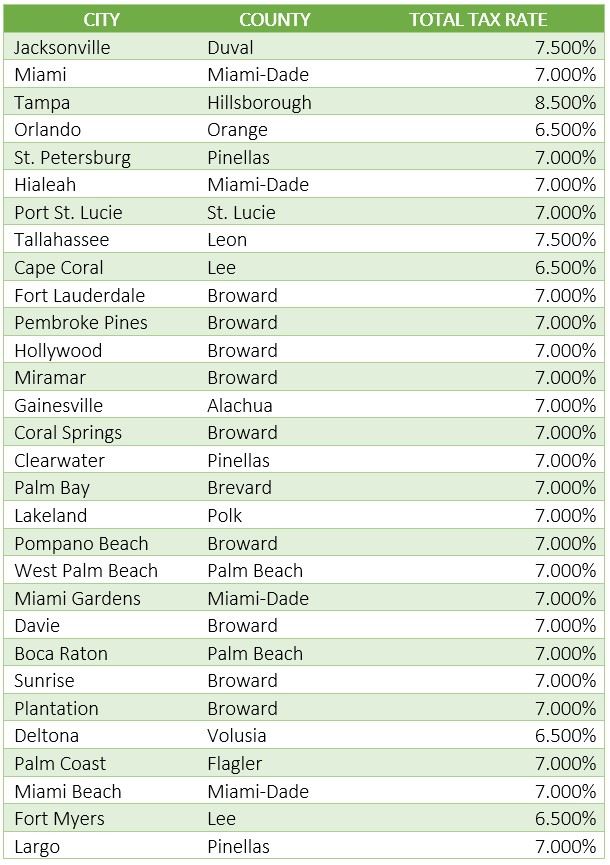

Sales tax in Pinellas County Florida is currently 7. The sales tax rate for Pinellas County was updated for the 2020 tax year this is the current sales tax rate we are using in the Pinellas County Florida Sales Tax Comparison Calculator for 202223. You can find more tax rates and allowances for Pinellas County and Florida in the 2022 Florida Tax Tables.

This rate includes any state county city and local sales taxes. Tax collector on pinellas county tax IMPORTANT. What is the sales tax rate in Pinellas Park Florida.

Fast Easy Tax Solutions. Pinellas County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Pinellas County totaling 1. Input the amount and the sales tax rate select whether to include or exclude sales tax and the calculator will do the rest.

The state of Florida imposes 6 sales tax on the full purchase price less trade-in. 727 464-3207 FAX. Puerto Rico has a 105 sales tax and Pinellas County collects an additional 1 so the minimum sales tax rate in Pinellas County is 7 not including any city or special district taxes.

If this rate has been updated locally please contact us and we will update the sales tax. Remember our emails will always come from Pinellas County Tax CollectorScam emails will have a different FROM name. 727 464-3448 TTY.

This is the total of state and county sales tax rates. The County sales tax rate is. Did South Dakota v.

The latest sales tax rate for Pinellas Park FL. SalesTaxHandbook visitors qualify for a free month by signing up via our partner program here. Pinellas County collects on average 091 of a propertys assessed fair market value as property tax.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Pinellas County. If you gleamed how to apply the discretionary surtax cap just from this sentence then you would. So if you live in Escambia County and buy a used car for 5000 you pay 75 in county sales tax plus the state sales tax of 300 on your purchase price for a total of 375 in sales taxes.

The Pinellas County Sales Tax is collected by the merchant on all qualifying sales made within Pinellas County. Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale and remit the taxes to the Florida Department of. The Florida state sales tax rate is currently.

The current total local sales tax rate in Pinellas County FL is 7000. And instantly calculate sales taxes in every state. The 2018 United States Supreme Court decision in South Dakota v.

The 6 state sales tax will be collected on the purchase price less any trade amount or previous sales tax paid in a state reciprocal with Florida. US Sales Tax Rates FL Rates Sales Tax Calculator Sales Tax Table. The December 2020 total local sales tax rate was also 7000.

This one sentence is probably the root of most of the confusion surrounding the bulk sale rule. Has impacted many state nexus laws and sales tax collection requirements. FL Rates Calculator Table.

The median property tax in Pinellas County Florida is 1699 per year for a home worth the median value of 185700. This table shows the total sales tax rates for all cities and towns in Pinellas. The sales tax rate for Pinellas County was updated for the 2020 tax year this is the current sales tax rate we are using in the Pinellas County Florida Sales Tax Comparison Calculator for 202223.

The Rule starts out by providing the surtax does not apply to the sales amount above 5000 on any item of tangible personal property. The estimated cost to register and title a vehicle for the first time is 42000 plus any sales tax due. We want you to be fully informed about Floridas property tax laws so you can enjoy your dream home as a resident of Pinellas County for many years to come.

The minimum combined 2022 sales tax rate for Pinellas Park Florida is. The Pinellas County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Pinellas County local sales taxesThe local sales tax consists of a 100 county sales tax. 2020 rates included for use while preparing your income tax deduction.

This is the total of state county and city sales tax rates. Groceries are exempt from the Pinellas County and Florida state sales taxes. The Pinellas County sales tax rate is.

Even when your car costs more than 5000 the county sales tax is still only 75 because Florida state law limits the tax to the first 5000. Pinellas County has one of the highest median property taxes in the United States and is ranked 640th of the 3143 counties in order of median property taxes. You can find more tax rates and allowances for Pinellas County and Florida in the 2022 Florida Tax Tables.

The sales tax rate for Pinellas County was updated for the 2020 tax year this is the current sales tax rate we are using in the Pinellas County Florida Sales Tax Comparison Calculator for 202223. The Florida sales tax rate is currently. The local sales tax rate in Pinellas County is 1 and the maximum rate including Florida and city sales taxes is 75 as of May 2022.

Ad Lookup Sales Tax Rates For Free. The total sales tax rate in any given location can be broken down into state county city and special district rates. To review the rules in Florida visit our state.

In addition to the state sales and use tax rate individual Florida counties may impose a sales surtax called discretionary sales surtax or local option county sales tax. 727 464-3370 HOURS. The median property tax on a 18570000 house is 194985 in the United States.

Pinellas County residents pay an additional 1 on the first 5000. Sales Tax Calculator Sales Tax Table. Our offices have been informed of fraudulent emails being sent to our customers they are disguised to look like our registration renewal email reminders.

In addition Pinellas County residents will pay the 1 Pinellas County local option sales tax on the first 5000 of.

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Florida Sales Tax Calculator Reverse Sales Dremployee

Florida Sales Tax Guide For Businesses

Tax Certificate And Tax Deed Sales Pinellas County Tax

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties

Florida Sales Tax Rates By City County 2022

File Sales Tax By County Webp Wikimedia Commons

Florida Vehicle Sales Tax Fees Calculator

Orlando Hotel Tax Rates 2019 Tax Rates For All Of Florida

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties

Florida Income Tax Calculator Smartasset

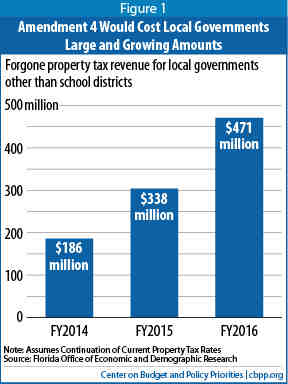

Florida S Amendment 4 Would Cause Tax Rate Increases And Deep Local Service Cuts Likely Harming The State S Economy Center On Budget And Policy Priorities

Millage Rates Pinellas County Tax